Tailored, free mortgage advice – to fit your home and your future

Meet Margo is an award-winning mortgage brokerage founded in 2022 by us, Matt and Claire Towe. Since then, our team’s grown with the very best expert mortgage advisers, insurance advisers and case managers in the UK. We’ve helped thousands of women navigate homeownership—from finding the best mortgage deals, to remortgaging and insurance, we’re with you at every step.

“We started this

journey because we

could see a lack of

tailored support

helping women

overcome challenges

of owning a home, so

we rolled up our

sleeves and built a five

star brokerage from

our kitchen table.”

We offer residential, buy-to-let, and holiday let mortgages, along with personal and business insurance covering life, critical illness, key person, and income protection. Plus, comprehensive home and landlord insurance for complete protection.

Why mortgages for women?

How are we different

from other mortgage brokers?

We offer expert, fee-free mortgage advice that acknowledges the hurdles women face, empowering them to make confident, informed decisions about their homes.

A complimentary will

We provide a complimentary digital will (worth £130) through our partner MyLastWill, to encourage more women to take control of their finances.

The National Will Register found only 44% of UK adults have a will, and just 39% of women compared to 50% of men. This service is not regulated by the Financial Conduct Authority and may have limited consumer protection.

A complimentary will

We provide a complimentary digital will (worth £130) through our partner MyLastWill, to encourage more women to take control of their finances.

The National Will Register found only 44% of UK adults have a will, and just 39% of women compared to 50% of men. This service is not regulated by the Financial Conduct Authority and may have limited consumer protection.

A complimentary will

We provide a complimentary digital will (worth £130) through our partner MyLastWill, to encourage more women to take control of their finances.

The National Will Register found only 44% of UK adults have a will, and just 39% of women compared to 50% of men. This service is not regulated by the Financial Conduct Authority and may have limited consumer protection.

Matt Towe

CEO & Cofounder

Claire Towe

Brand Director & Cofounder

With over 15 years of experience in brand communication, I’ve had the privilege of working with some of the UK’s largest consumer brands. This experience has given me a deep understanding of how to connect with people in an authentic and relatable way. As a young mum of two who once struggled with my own finances, I’ve made it my mission to use my skills to help more women take control of their home finances. Through Meet Margo, I’m dedicated to making great financial advice more accessible and empowering more women to take control of their futures.

Claire Towe

Brand Director & Cofounder

With over 15 years of experience in brand communication, I’ve had the privilege of working with some of the UK’s largest consumer brands. This experience has given me a deep understanding of how to connect with people in an authentic and relatable way. As a young mum of two who once struggled with my own finances, I’ve made it my mission to use my skills to help more women take control of their home finances. Through Meet Margo, I’m dedicated to making great financial advice more accessible and empowering more women to take control of their futures.

Fee-free advice

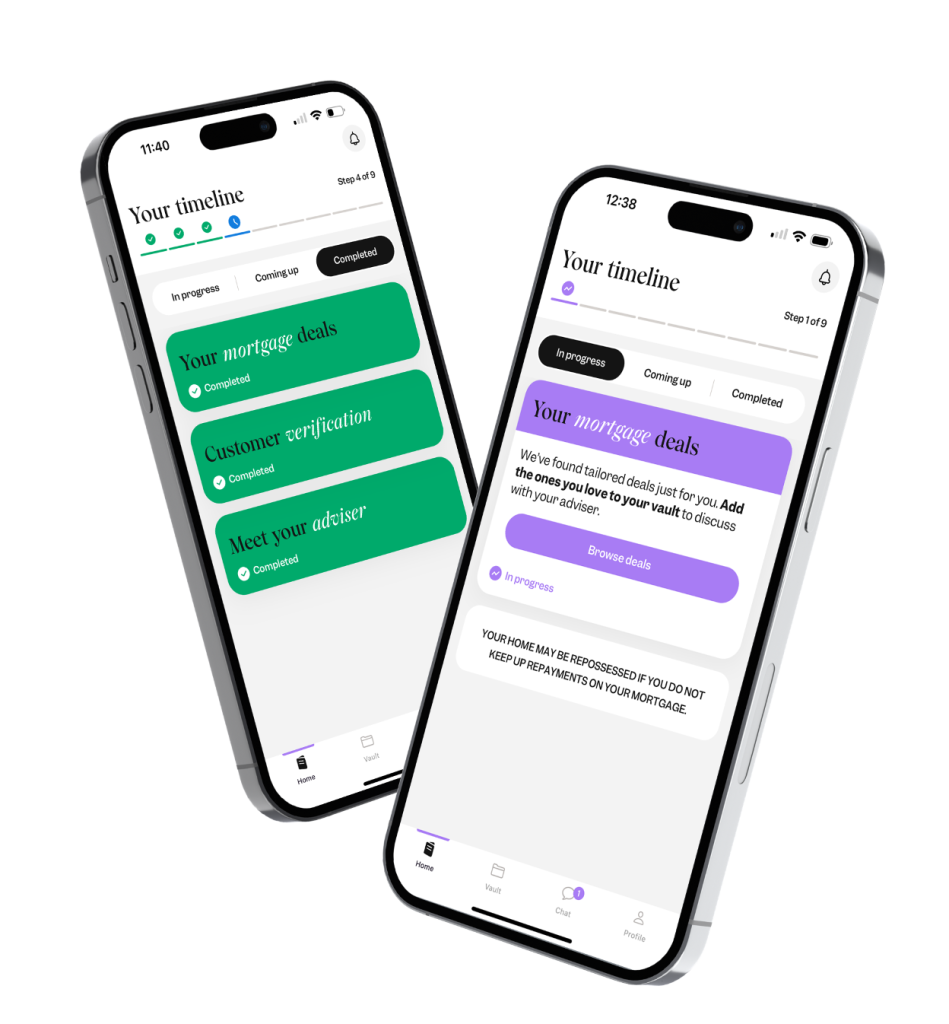

Tech-first approach

Sharing our mission

Our values

-

Simplicity in everything we do

We believe in stripping away unnecessary complexity and strive to keep things easy to understand, bringing a spirit of integrity, care, and trust to everything we do.

-

We believe in finding solutions

We embody a can-do attitude, believing in the power of positivity, creativity, and teamwork to overcome any challenge that comes our way.

-

We put people first

We believe our strength comes from our team and the people we help. Their homes are in our hands. We take it personally. Always.

-

We believe in empowering others

As a team, we're dedicated to constantly learning and growing, knowing that knowledge is the key to empowering both ourselves and the women we help.

Our

Frequently asked questions

The legal bit.

Your Property may be repossessed if you do not keep up repayments on your mortgage.

Meet Margo’s advice and guidance are completely free for customers to access because we are paid a procuration fee from the lender.

If you are unhappy then we want to hear about it so we can try to put things right. With this in mind, we have the following complaints procedure in place. View here.

© 2024 Meet Margo.

Registered in England & Wales. Company number 13887760.

Registered address: 5 Merchant Square, London W21AY.

Meet Margo is a trading name of Meet Margo Ltd who are an Appointed Representative of PRIMIS Mortgage Network, a trading name of Personal Touch Financial Services Ltd. Personal Touch Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

The guidance and/or information contained within the website is subject to UK regulatory regime and is therefore targeted at consumers based in the UK.